What are our customer’s needs and goals?

Methodology

When I ask organisations do they know who their customers are, I get a surprise, “Yes, of course.” Then I ask for the research.

This is where it starts to unwind. It doesn’t exist. There are years of assumptions, and hearsay, coupled with segmentation data points – all rolled into the pen portraits that have become supposedly the truth.

Thinking you know what your customers are trying to achieve and actually being fully informed are two very different things. It’s uncomfortable, to say the least. It asks the question of how have we survived not knowing and who is to blame. You need to start now. It’s not even complex.

Let us look at the process in more detail:

- Hold an empathy mapping session, to enable participants from across the organisation to see for themselves how many assumptions there are

- Review segmentation to understand the share of customers, who generate sales and who is most profitable and importantly who is under-represented today

- Create a recruitment screener from the segmentation. A professional recruitment organisation alongside incentives is expensive – it can be handled internally with a little effort for a fraction of the cost

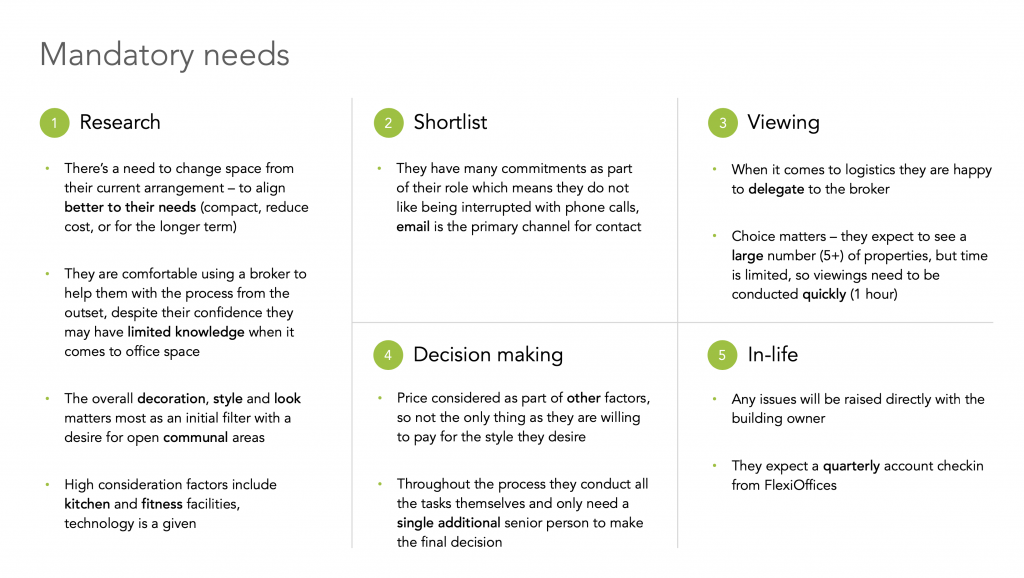

- Develop a discussion guide to develop insights across the entire customer journey

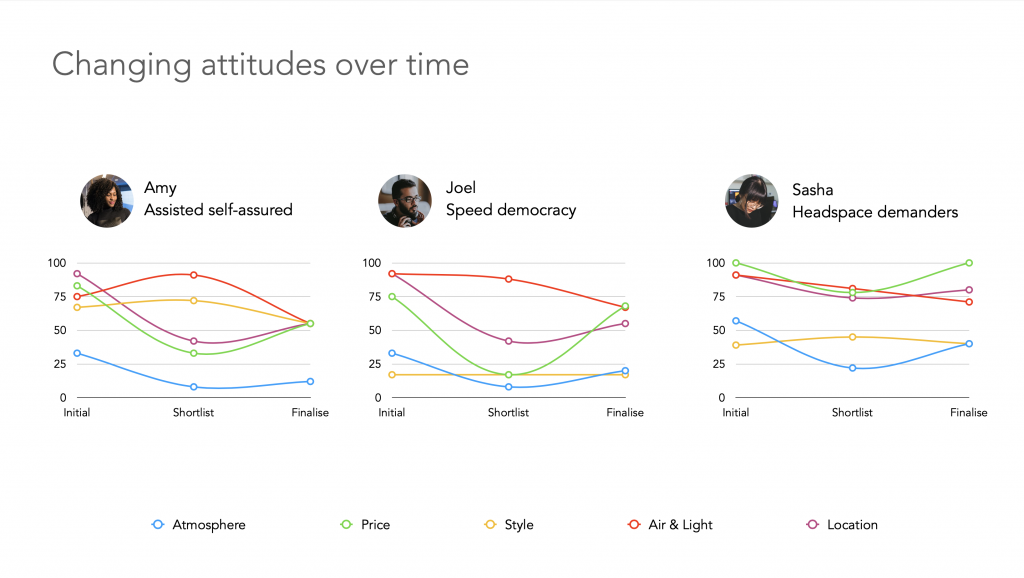

- Analyse results using clustering techniques to understand how many groups of customer behave in similar ways. Note, it could very different from the number of segments

- Produce a visual pack that brings these customers to life – being memorable

- Share across the organisation and plan for change – be a customer-centric organisation by doing

Outcome

There are two types of organisations – those who attempt to create propositions for customers and continually course-correct because it doesn’t work and those who are customer-centric and embed the customer in every single process.

Developing research-created personas enables:

- Less bias – who is the actual customers we are servicing

- Faster time to solution – no debating what customer x might or not want as guesswork based on personal opinions

- Common language across teams – enabling them to talk about the customer in the same way

- A MARS assessment to take place – in that what processes are missing or ad hoc in satisfying goals

Timeline: 10 weeks

- 1 week – empathy session with the RACI team

- 1 week – recruitment screen and discussion guide development

- 4 weeks – participant recruitment

- 2 weeks – in-depth interviews/remote research

- 2 week – analysis and synthesis

Ready to talk about your customers?

Pragmatic and cost-effective research

Customers & Proposition

What are our customer’s needs and goals?

Are you making assumptions about who your customers are? Be more worthwhile to them by helping them achieve their goals.

We need to be innovative. Where do we start?

Do you need to create a standout idea but are struggling to get out of the current way of doing things?

How do we organise our platform to perform well?

Are you sure the taxonomy and information architecture are easy to use to reduce bounce and encourage return use?